My non owner car insurance blog 0205

AboutGetting The Average Monthly Car Insurance Rates To Work

Common Question, Is it possible to get a 0% rates of interest on an auto loan? Yes with good credit you might have the ability to make the most of special deals like a 0% yearly portion rate. Find Additional info out more about some ways to assist you get 0% APR on your next auto loan.

The longer you extend your loan period, the lower your regular monthly payment will be. However with a longer loan term, you'll pay more in overall interest. This example demonstrates how the interest and loan term can impact the overall amount you could pay for your vehicle loan. Total vehicle loan amount $32,300 Rates of interest 7.

Here are several more. Vehicle insurance is required in the majority of states. A range of factors, including your driving history and age, can influence the cost of your automobile insurance coverage. An insurance representative can offer you a quote for the automobile you're considering purchasing. The average car insurance coverage premium in the U.S.

Some states likewise charge a lorry real estate tax, based on your vehicle's worth. Depending on where you work and live, you may require to factor parking costs into your budget. Parking costs vary by city. The median month-to-month parking cost was greatest in New york city City at $616 and lowest in St.

Excitement About Tesla Wants To Base Its Car Insurance In Texas On What?

If you live in a bike-friendly town or city, biking can be a lower-cost or even complimentary choice. Business like Lime now make it simple to lease a bike or scooter for around $1 to open, with an additional charge per minute. The marketed rate of a vehicle is simply one consideration when computing the overall cost of owning a car.

Wondering how much the cost of cars and truck insurance will be for that stunning new automobile you've been dreaming about? You're not alone. And landing on that exact number can be tough for a number of reasons due to the fact that insurance rates can differ by cars and truck type and the age of the automobile.

However other elements like your personal monetary history and your household's driving records can all influence the cost of your premium too. To better understand what elements remain in play, let's take an appearance at what enters into calculating the expense of car insurance coverage and dig deep into the elements that sway your insurance coverage costs.

How Tesla Insurance can Save You Time, Stress, and Money.

They'll likewise ask you about your favored protection limitations, which can adjust the cost of your vehicle insurance policy.

If you get wed or separated, it's best to get in touch with your American Family Insurance coverage representative as quickly as possible to let them know of the change. Typically, this will mean you'll be altering your policy, whether you're including your new partner or removing your ex. You may be able to save cash on automobile insurance with a great credit ranking.

If you have actually not had a significant mishap in 5 years, this can benefit your vehicle premium. When no property damage or liability claims have been made versus you in the current past, you stand to get a much better rate. The expense of your cars and truck and the year it was produced will be used to assist generate your insurance rates.

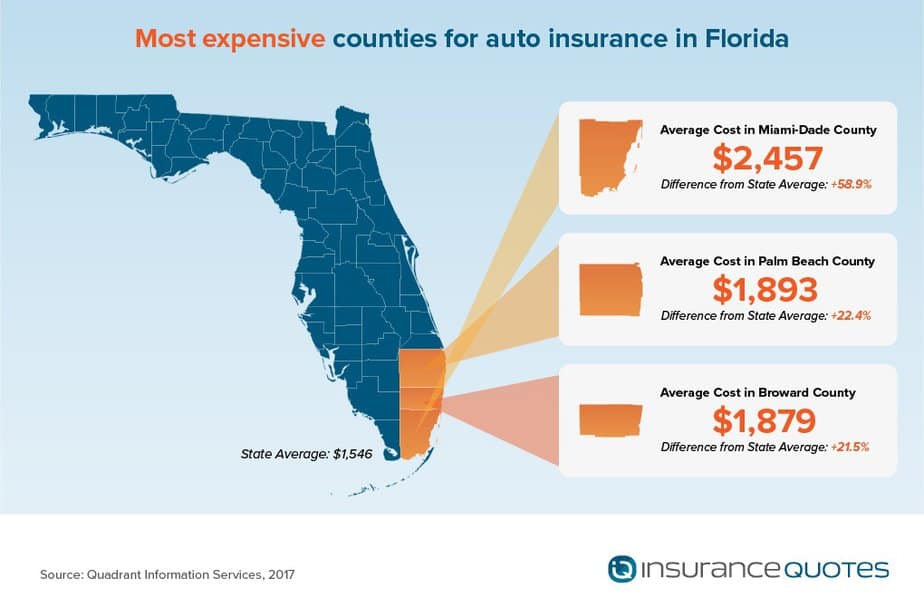

The location and postal code where your automobile is signed up will have an influence on the amount you spend for insurance coverage. Safe neighborhoods with low crime rates are typically connected to lower insurance rates. If you have the ability to bundle other policies with your vehicle coverage, you can save on your premium.

Not known Details About Here's Exactly How Much To Save Each ... - Arizona Daily Star

With American Family Insurance, you may be able to conserve big. You'll likely be asked about the method you mean to utilize your cars and truck when you use for auto insurance.

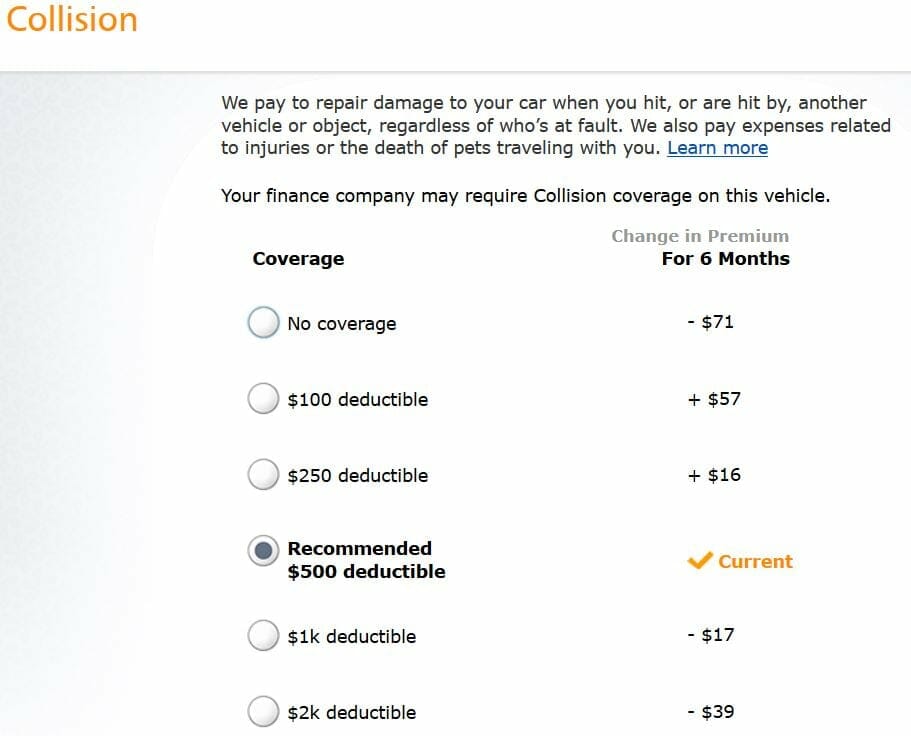

One method you can manage the expense of your car insurance coverage is to request quotes on various coverage limits. By adjusting these limitations and your deductible, you need to be able to discover the coverage you require.

, you might be doing yourself a big favor if you're ever found responsible for an accident that triggered injuries to others.

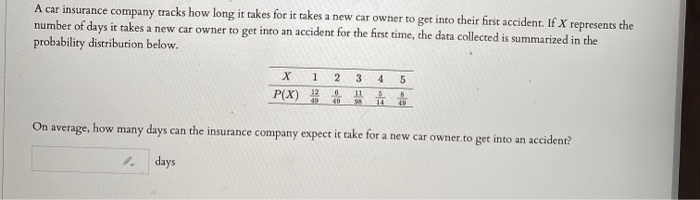

It's not unusual to invest $1,000 - $4,000 annually on cars and truck insurance. Young chauffeurs and poor driving records tend to send out the costs skyrocketing. Read this shocking research study to discover the typical vehicle insurance expenses and how you can minimize them. Average Cars And Truck Insurance coverage Expense Drivers invest a typical annual rate of $936 on car insurance coverage.

Indicators on Car Insurance Estimator - Coverage Calculator - Geico You Should Know

Particular states need complete insurance protection, while others only need liability insurance coverage. The typical chauffeur pays $78 a month for car insurance.

This is likely due to the few years of experience they have driving. However, a bad driving record can send out that average sky high quickly. The average cost for cars and truck insurance coverage is about $1,500 a year when a driver turns 21. This is a roughly 50% reduction from the average yearly rates of a 20-year-old.

New Jersey has actually always had typical automobile insurance rates as much as 50% more than the rest of the U.S. He also noted that lots of drivers carry more insurance coverage than is legally required, which raises the state's numbers.

Iowa lucks out with the most affordable liability insurance premiums in the nation. Iowans pay an average annual of $312 for liability insurance coverage, 58% lower than the rest of the U.S.

How Pay-per-mile Auto Insurance Works – Forbes Advisor - The Facts

https://www.youtube.com/embed/Ptg2xjeBWAkThis produces expensive claims and greater rates as an outcome. Idaho has the most affordable combined insurance premiums. At $711 annually, they pay around 40% less than the remainder of the states. Did You Know? Californians pay an average of $893 a year for minimum protection. As with other areas, your individual cars and truck insurance rates depend on your postal code and other elements.

About9 Simple Techniques For How To Lower Car Insurance Premiums In California

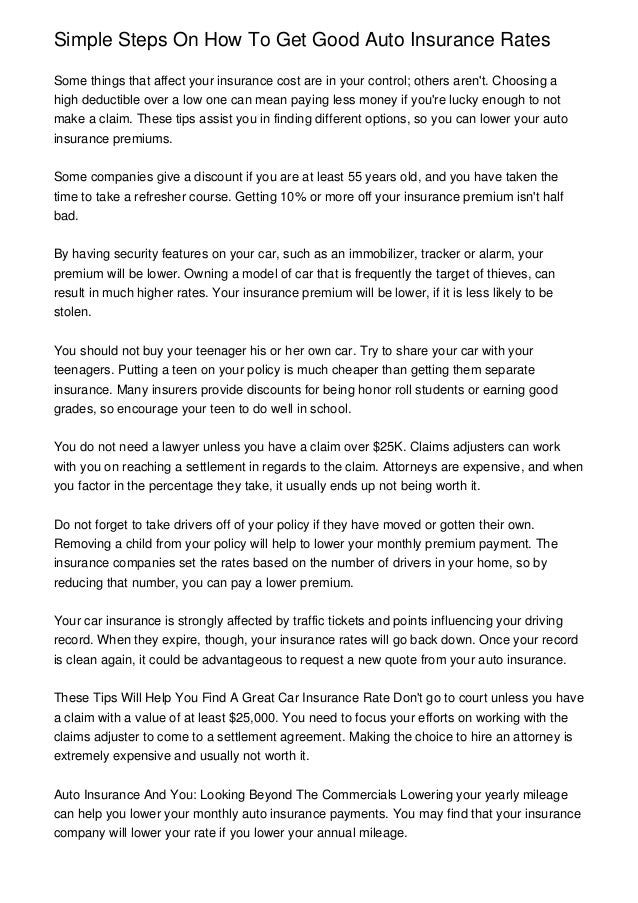

Raising your deductible can save you so much cash on premiums that you'll likely still invest less money yearly, even if you strike your deductible during the year., though you in some cases have to ask about them.

Having vehicle insurance is very important, but rates frequently increase in time and it prevails to overpay. None of these tips will make your cars and truck insurance coverage totally free, however they can make it more affordable so that you can get the coverage you need for a sensible cost. Discover low premiums with Jerry The outright quickest method to change your premium is to switch insurance coverage carriers.

People who drive occasionally may want to consider usage-based insurance coverage, which utilizes technology to keep track of driving and can save about 3 percent, the report found. Here are some concerns and answers about automobile insurance coverage: Yes.

8 Simple Techniques For How To Lower Your Car Insurance Rates

The chauffeur of a three-year-old Honda Accord would conserve about 12 percent on premiums compared to the cost of insuring a brand-new design, the report discovered. If you are looking for a vehicle and desire to keep insurance rates down, consider a carefully used, late-model cars and truck, Mr. Linkov stated. All states other than New Hampshire require minimum levels of liability coverage, which spends for another individual's residential or commercial property damage, treatment and other costs caused by you.

They include crash protection, which pays for damage to your cars and truck if it strikes another car or something else, like a tree or a wall; and comprehensive coverage, which covers damage to your automobile from the majority of whatever else, like fire, hail, flooding and theft. Insurance providers may use discount rates for bundling car coverage with other types of insurance coverage, like property owner or renter's policies.

13 Factors That Affect Car Insurance Rates - Insure.com for Beginners

Know the elements affecting vehicle insurance coverage premiums and discover how to reduce insurance coverage costs. You pay one quantity for vehicle insurance coverage, your best pal pays another and your next-door neighbor pays still another quantity.

The opposite can use for less safe trips. Some insurers increase premiums for cars and trucks more prone to damage, occupant injury or theft and they lower rates for those that fare much better than the norm on those steps.

Before you head down to the dealer, do some research study on the cars and truck you want to acquire. Does the lorry that has captured your eye have strong security rankings? Is this specific model typically stolen? Understanding the responses to a couple of simple concerns can go a long way toward keeping your rates low.

The Ultimate Guide To How To Get Cheap Car Insurance: Our Tips For A Cheaper Car ...

, urban chauffeurs pay more for car insurance than those in small towns or rural areas.

If you've been accident-free for an extended period of time, do not get complacent. Stay mindful and keep your good driving habits. If you are insured and accident-free for 3 years, you likely get approved for a State Farm accident-free savings. And although you can't reword your driving history, having an accident on your record can be an essential pointer to constantly drive with caution and care.

, specifically single males.

How To Lower Car Insurance Premiums In California Things To Know Before You Buy

If you're a student, you may be in line for a discount rate. The majority of automobile insurance companies provide discounts to trainee motorists who keep good grades. What are methods to help lower cars and truck insurance premiums? Dropping unneeded protection, increasing your deductible or lowering coverage limitations may help lower insurance coverage expenses. Your insurance agent can share the advantages and disadvantages of these options.

Overall, it doesn't injure and may really well assist. These use based automobile insurance programs tape-record the miles you drive and use that info to help identify your premium.

Ask whether your insurance company offers a discount rate for paying the six-month term in advance. There might also be cost savings for having your monthly payments automatically subtracted, but check whether this will sustain a charge from your bank or credit card company.

Indicators on Why Is My Car Insurance So High? 13 Reasons Why ... - Insurify You Need To Know

There are several websites that can supply instantaneous quotes for automobile insurance from numerous companies along with providing contact numbers for local agents. Beware, nevertheless, of buying vehicle insurance straight online without a local agent. Your automobile insurance rates will decrease as you raise the deductible quantities on your policy.

If you have a deductible of $100 on your automobile policy and have $1,000 worth of damage, you pay the first $100 and the insurance company pays $900. Deductibles are not readily available on liability protection. The majority of insurance companies utilize your credit rating in addition to mishaps, violations, age and location to identify your premiums.

https://www.youtube.com/embed/7vmK0ef1WLM

In some cases, a company's rates without a discount rate can be lower than those of other business that provide discount rates. Try to pay for your car insurance coverage for the complete policy duration.

AboutNot known Factual Statements About Car Insurance For Teenage Drivers - Edmunds

Laws on this vary from state to state. Some states require teens to be insured when they receive their learner's authorization; somewhere else, you can wait up until your teen has a chauffeur's license to include them to your policy. Also, some business will let you include a teenager with a student's authorization to your car insurance coverage policy free of charge; others will not.

This offers you a starting point to work with and to see if you can find a lower rate. Should I Buy Different Vehicle Insurance Coverage for My Teenager? In basic, it's more affordable to include your teenager to your existing cars and truck insurance coverage than to acquire a separate policy for him or her.

Buying such a policy can reduce the expense of your child's insurance while enabling you to keep your existing car insurance protection and low rates. How Do I Include My Teen to My Car Insurance coverage? When seeking the least expensive cost on cars and truck insurance coverage for a teen motorist, begin with your present insurance company.

As soon as you know what type of protection your current business recommends, shop around to see if you can get a lower rate. Be sure to compare the exact same type and quantity of coverage and deductibles from one company to another.

Average Cost Of Insurance For A Teenage Driver - Insurify - The Facts

If your existing insurance provider offers mishap forgiveness, which normally requires going three to five years without an accident to work, you'll need to begin all over with a brand-new service provider. How to Minimize Car Insurance Coverage for a Teenager Motorist, No chance around it, insuring a teen chauffeur is pricey.

Delay Getting a Driver's License, If money is tight, think about whether your teen truly needs to drive or whether they can wait. As teenagers get older, their premiums normally decrease, so putting off licensing even a couple years can conserve you a fair bit of cash. Given the cost of guaranteeing a teen chauffeur, having your teen utilize public transportation and even take rideshares to get where they require to go might really be more cost-effective.

Many companies also use "away-from-home" discount rates for college trainees who live far from home, do not take a cars and truck to college, and drive the family vehicle only when they're house on break. Insurer may decrease rates if your teenager takes a chauffeur education or driver safety course authorized or provided by the company.

Simply understand that if the app or gadget discovers that someone in your household isn't a safe chauffeur, or that you drive more miles than anticipated, your rates could rise. Pick the Right Car, Planning to gift your teenager a brand-new car to go with that glossy new license? You may wish to reconsider.

Not known Details About 6 Ways To Lower Car Insurance Costs - Virginia Credit Union

Insurer generally appoint a primary driver to each cars and truck, calculating premiums in part on that driver's record. If your teen has a dedicated automobile (whether they or you are on the title), they will be listed as the main chauffeur on that automobile. Preferably, you desire your teenager designated as a secondary motorist on all of your automobiles, or as primary chauffeur to the least important cars and truck in the household.

Check car-shopping sites such as Kelley Blue Book and Edmunds to identify your car's worth and determine whether your money may be better invested saving up for a new cars and truck. While you can cut some types of protection, you might need to bump up other types of automobile insurance protection when you have a teen chauffeur.

Look For Automobile Insurance Online, Some insurer offer you a discount for getting a quote online or starting or finishing the purchase process online. Insurance companies conserve time and cash when they don't need to pay an agent to assist you, and numerous pass the cost savings on to you.

But by taking some time to research your alternatives, you can find automobile insurance that will safeguard both your teenager and your bank account.

Everything about Car Insurance For Teens - Nationwide

With this awareness comes the difficult fact for many parents when confronted with adding a teen driver to their vehicle insurance policy. A 2020 research study by Coverage supplies a sobering figure for parents adding a teenager to insurance anticipate premium increases around 130% to add a 16-year-old teen chauffeur to the vehicle insurance plan.

How to Include a Teenager Motorist to Your Automobile Insurance, Follow these actions for adding a teen driver to your cars and truck insurance coverage. Before your teen gets their learner's permit, have a discussion with an insurance agent about when to include the teenager to the policy, when they get their authorization or as soon as they receive their motorist's license.

The majority of insurance specialists suggest liability limits of at least 100/300/100. Ask the representative about discount rate eligibility for your teen to assist lower the cost of adding them to the cars and truck insurance coverage. Get quotes from other vehicle insurer to see who provides the best rates for your family when including a teenager to the insurance coverage plan.

These programs usually include a discount for getting involved, with an extra discount awarded for safe driving practices. Each year or policy renewal, shop around for quotes and inquire about new discount rates offered so you can get the least expensive rates possible. How a Teenager Motorist Impacts Vehicle Insurance Coverage Premiums, Though the average expense boost for adding a teen chauffeur to cars and truck insurance coverage is already high at about 130%, the expense could be even greater if the teenager is male.

The Teen Driving - Auto Coverage From National General Insurance Statements

The teen chauffeur security and discount programs, there are numerous other discount rates teens can be qualified for: Full-time trainees with a B or above GPA in school can get a discount rate for having good grades in high school or college, as long as they are single and under 25.

Parents can lead by example and utilize the app data to discuss safe driving habits with teenager chauffeurs while likewise monitoring when and where they are driving when the moms and dad is not with them. Insurance coverage rates differ by make and model, so it might make sense to get a different automobile. Parents may be able to drop detailed and accident if they buy an older automobile.

AboutAuto Insurance Rates Decreasing In 2021 For The First Time - Truths

By not raising any claim throughout the policy duration, will I get any discount? Yes, you get it in the form No Claim Perk (NCB); nevertheless, do not stop from raising a claim in case the cost to repair the automobile is high.

There are a number of sites that can provide immediate quotes for auto insurance coverage from numerous business in addition to providing contact numbers for regional agents. Be careful, however, of purchasing automobile insurance coverage directly over the Web without a local representative. Your auto insurance rates will reduce as you raise the deductible quantities on your policy.

If you have a deductible of $100 on your auto policy and have $1,000 worth of damage, you pay the very first $100 and the insurance business pays $900. Deductibles are not available on liability protection. The majority of insurance coverage business utilize your credit report in addition to accidents, offenses, age and area to identify your premiums.

The Definitive Guide for Column: Why Isn't Car Insurance Cheaper As We All Stay Home?

Don't automatically assume that simply because you get a discount rate the rate is a great one. In many cases, a company's rates without a discount rate can be lower than those of other companies that provide discounts. Store around and compare rates. Try to spend for your auto insurance coverage for the complete policy period.

Significantly reduced your annual mileage. Relocate to a various community, town or state. Sell a car. Minimize the variety of chauffeurs in the family. Wed. Turn 21, 25 or 29. These changes in scenarios may lower your premium. Try not to purchase vehicle insurance coverage and health/accident insurance coverage that pay for the very same things.

Some associations, companies, or worker groups have insurance strategies readily available to members to purchase automobile (or other) insurance coverage through special arrangements with insurance provider. In many cases, the insurance provider might automatically accept all group members for insurance or just those members meeting their requirements. Group arrangements for insurance coverage may save you money, however, they may not always do so.

The 25-Second Trick For Why Do Car Insurance Premiums Increase Annually Or After ...

In this short article: In general, more youthful motorists tend to pay more for cars and truck insurancebut once you reach the age of 25, the cost of your insurance coverage can drop. According to , the average annual premium for a 24-year-old male with full coverage is $2,273. At age 25, that balance drops to $1,989, a decrease of about 12.

If you plan to wait until your policy renews, contact your insurer to make sure that you'll get a discount when it computes your rate for the next policy period. Ways to Lower Automobile Insurance Expenses, While you can't control all of the factors that go into your cars and truck insurance rateyour date of birth is set in stone, for instancethere are some that you can control.

It won't ensure a lower rate, but it could help. Some car insurance coverage companies offer optional coverage that's nice to have, but may not be worth the expense.

What Does When Will My Car Insurance Go Down? Mean?

Most insurance companies use discount rates to consumers who buy numerous policies. You may have the ability to minimize your automobile insurance by bundling it with occupants insurance coverage, homeowners insurance coverage, life insurance coverage, motorbike insurance or other policy types. Some insurance provider offer a discount rate if you go to a protective driving course, either online or in-person.

You'll likewise get real-time informs when modifications are made to your credit report, such as new accounts and questions. Monitoring your credit carefully will offer you the info you require to build and preserve a great credit history.

At what age will your vehicle insurance go down? Age is the most significant aspect in identifying your car insurance rates.

Everything about What Causes Your Insurance Premium To Go Up?

And keep in mind that no matter your age, you need to always compare auto insurance prices quote from several suppliers so you can find the finest coverage and cost for you. Utilize our tool listed below or give our group a call Motor1's designated quotes team at to secure free, tailored quotes seven days a week.

Insurance providers care about how experienced you are, so you'll most likely see a more considerable drop around your 25th birthday. Ultimately, the more years on the roadway you have, the lower your premiums will likely be. If you're a young chauffeur or the moms and dad of a teenager, you may be wondering when you can get some remedy for high automobile insurance rates.

Your insurance coverage company will look at the variety of years you've been driving and your driving record recently. This will assist identify any modifications in your premium. As you get experience and continually drive without mishaps or tickets, you're most likely to see a reduction in your automobile insurance rates.

Unknown Facts About How Does Where You Live Affect Your Auto Insurance Rate?

Car insurance rates are identified by the amount of danger a motorist poses to an insurance company. This risk is identified by typical motorist statistics. Insurer wish to safeguard themselves, so they charge a higher rate for chauffeurs who are most likely to enter into a mishap, sue, or get a moving offense.

16- to 19-year olds are almost three times more likely to be in a deadly crash than drivers age 20 and older. They have less experience driving, so they are more most likely to have a mishap usually. Crashes with teenage motorists in America are frequently the result of the following: Lack of experience with driving Sidetracked driving Driving with other teenage passengers Impaired, reckless, or sleepy driving Driving at night In spite of the reality that teenagers pay more than adults for high-risk vehicle insurance coverage, you can still go shopping around for rates within your spending plan.

https://www.youtube.com/embed/zG3ghj_nOwQ

To save money on car insurance coverage, many families think about registering teenagers in safe driving programs or drivers ed courses. These programs are built to alert motorists when they are succeeding, as well as where to make changes to improve security. A lot of insurance provider provide discount rates to teenagers who complete these programs successfully and reveal indications of safe, accountable driving.

AboutThe 2-Minute Rule for Auto Insurance: Common Myths

2Take Motorist's Education and Motorist's Training Classes, You can conserve a great deal of money on vehicle insurance by taking. New motorists are tough to insure because they are not always mindful of the rules of the roadway, and they are unskilled. There are all examples you can learn with these classes, which are targeted at making people better chauffeurs.

As a brand-new motorist, you are probably going to be charged greater rates for your insurance than other chauffeurs who have actually been on the roadways for years. Here is a short guide that assists you get all the discounts you are entitled to: If you do your research, get quotes, take motorist's education, have a good working more recent car, and even use your parent's insurance coverage, you will find that you can save a great deal of money.

In addition, if you're funding the vehicle, your lending institution will likely need you to have insurance at the time of the purchase. If you already have car insurance and you're changing your car, you typically have anywhere between 7 to 30 days to notify your insurance coverage business of the purchase.

The Buzz on How To Get The Best Auto Insurance: 4 Tips For New Drivers

With an existing policy which contained detailed and accident, your car insurance premium for these protections will be adjusted based on the new car make and design. Your liability premium will likewise be impacted. Notify your insurer about the brand-new cars and truck within the proper window, if you are given a grace period to include it, or you might be driving without protection.

For example, some insurance providers supply automated protection for the additional car but you should still inform them within one month, while other insurance companies provide no automated coverage for additional cars. When you're buying https://canvas.instructure.com/eportfolios/596118/carinsuranceforteenscgah423/Get_This_Report_about_Do_You_Need_Insurance_Before_Buying_A_Used_Car a brand-new car, you truly need to also search for cars and truck insurance. Even if you have an existing vehicle policy, it might be more affordable to guarantee your cars with a brand-new car insurer.

For more, check out car insurance protection for new cars and trucks..

Some Known Incorrect Statements About Cheap Car Insurance For First-time Drivers

Noted listed below are other things you can do to reduce your insurance coverage costs. 1. Search Prices differ from business to company, so it pays to search. Get at least three rate quotes. You can call companies straight or access information on the Web. Your state insurance coverage department may likewise provide comparisons of prices charged by significant insurance companies.

It's important to pick a company that is economically steady. Get quotes from different types of insurance coverage business. These agencies have the exact same name as the insurance company.

Do not go shopping by cost alone. Contact your state insurance department to discover out whether they offer info on customer grievances by business. Pick a representative or company representative that takes the time to address your questions.

What Does Is It Hard To Get Car Insurance For The First Time? Do?

2. Prior to you purchase a cars and truck, compare insurance costs Prior to you purchase a new or secondhand car, explore insurance coverage costs. Cars and truck insurance premiums are based in part on the car's cost, the expense to fix it, its total safety record and the possibility of theft. Many insurance providers provide discounts for functions that reduce the threat of injuries or theft.

Evaluation your protection at renewal time to make sure your insurance requirements have not altered. 5. Buy your house owners and car protection from the very same insurance provider Numerous insurance providers will offer you a break if you buy 2 or more types of insurance coverage. You may also get a reduction if you have more than one vehicle insured with the exact same business.

Ask about group insurance coverage Some companies offer reductions to motorists who get insurance coverage through a group plan from their companies, through professional, organization and alumni groups or from other associations. Ask your employer and inquire with groups or clubs you belong to to see if this is possible.

All About Buying Your First Car Insurance? Here Are Some Tips…

Look for other discount rates Business offer discounts to insurance policy holders who have actually not had any accidents or moving offenses for a number of years. You may also get a discount rate if you take a defensive driving course. If there is a young chauffeur on the policy who is a good trainee, has taken a chauffeurs education course or is away at college without a vehicle, you might likewise get approved for a lower rate.

The essential to savings is not the discount rates, but the final rate. A company that provides few discount rates may still have a lower overall rate. Federal Citizen Information Center National Consumers League Cooperative State Research, Education, and Extension Service, USDA.

Sign Up With an Existing Strategy Newbie chauffeurs, specifically teen chauffeurs, have higher than typical rates for automobile insurance coverage. Insurance coverage business see them as risky due to the fact that they lack experience, might text and drive, and are most likely to engage in other kinds of distracted driving or dangerous habits. One thing you can do is get on a household member's plan with a good driving record.

The Only Guide to How To Buy Your First Car - Comparethemarket.com

Lots of novice automobile purchasers make the error of selecting the first insurance coverage representative or company they talk to, so they can drive off the car lot. What Is the Typical Expense of Cars And Truck Insurance Coverage for First-Time Drivers?

Inexpensive Car Insurance Coverage for First-Time Drivers Insurance discount rates differ between companies, and the names may be various, however here are some that you should keep an eye out for. Driving History and Habits Discount Rates Protective Driving Course. Your insurance company will typically point you towards authorized schools and courses. Depending on the discount rate and cost of the course, you may recover the price of the schooling and still save cash total.

Purchasing automobile insurance coverage online can offer you a discount rate. Multi-Policy. Are you relocating to your top place or wanting to rent while you attend school? You can include a tenants policy and get an offer on your cars and truck insurance coverage. If you own or condo or house or cope with somebody who does, think of bundling all family policies with the same business.

The 6-Minute Rule for How To Shop For Car Insurance To Get The Best Deal - Business ...

https://www.youtube.com/embed/XUkRx6Z0RwYThe majority of insurance companies will not provide an automobile policy without the VIN. Car's mileage Date of purchase Names of registered owners Credit, debit, or bank routing and account number.

AboutFascination About How To Get Cheaper Car Insurance For Your Teenage Driver

Before you buy a vehicle, compare insurance costs Prior to you purchase a brand-new or used vehicle, examine into insurance expenses. Automobile insurance premiums are based in part on the vehicle's cost, the expense to repair it, its overall security record and the likelihood of theft.

Evaluation your coverage at renewal time to make sure your insurance coverage needs haven't altered. 5. Purchase your house owners and auto coverage from the same insurance company Lots of insurance providers will provide you a break if you purchase two or more types of insurance. You may likewise get a reduction if you have more than one automobile insured with the same business.

Ask about group insurance coverage Some business provide decreases to drivers who get insurance through a group strategy from their companies, through professional, organization and alumni groups or from other associations. Ask your employer and inquire with groups or clubs you are a member of to see if this is possible.

7 Simple Techniques For Average Car Insurance Costs In 2021 - Ramseysolutions.com

Look for out other discount rates Companies use discounts to insurance policy holders who have actually not had any mishaps or moving violations for a variety of years. You might also get a discount if you take a defensive driving course. If there is a young motorist on the policy who is a great student, has actually taken a motorists education course or is away at college without a cars and truck, you may also get approved for a lower rate.

The key to cost savings is not the discount rates, but the last rate. A company that offers couple of discount rates may still have a lower overall rate. Federal Citizen Information Center National Consumers League Cooperative State Research Study, Education, and Extension Service, USDA.

Portland Press Herald, Getty Images Low-cost cars and truck insurance for new drivers under 21 is not constantly simple to discover. Younger motorists are considered to be at a higher threat for coverage, meaning they typically receive the greatest insurance coverage rates. Understanding the typical expense of car insurance for more youthful motorists, and discovering what discounts are available, can help you reduce your insurance coverage rates, even if you are a brand-new driver.

The Single Strategy To Use For How To Get The Best Auto Insurance: 4 Tips For New Drivers

Data reveal that younger chauffeurs are more most likely to be in a mishap and submit a claim., the typical 21-year-old motorist pays about $850 more annually. The top insurance coverage providers for drivers under the age of 21 tend to be Allstate, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, and USAA.

State Farm provides the second-best rates, with approximately $1,319 every year. Lots of aspects, including your age, the vehicle you drive, and whether you are on your parent's policy, will increase or decrease this average. Although drivers under 21 pay the highest insurance rates, you might receive a considerable drop when you turn 21 years of ages.

What Factors Influence Insurance Rates for New Drivers Under 21? Knowing what elements contribute to your insurance coverage rates can help you identify discount rate possibilities. The list below elements are considered when identifying insurance coverage rates for a chauffeur under 21: Given that motorists under 21 have less driving experience, they are considered to be at greater danger of filing an insurance claim.

The Ultimate Guide To Cheap Car Insurance - Progressive

Where you park your automobile each night affects your insurance rates. If you live in a location with high criminal offense rates, your rates will likely be greater.

In addition to risking your life, a DUI can lead to high insurance rates. Some insurance service providers provide discount rates if you pay for your policy yearly.

Without it, you might face costly fines and even a suspended license. In lots of states, the fines that come with driving without insurance coverage are much more expensive than paying for an insurance policy. Insurance coverage is suggested to protect you and other chauffeurs if you are in an accident. Depending on the type of coverage, an insurance coverage may cover medical bills and vehicle damages.

All about Non Owner Car Insurance - How To Buy & What All It Covers

Finding cheap vehicle insurance coverage can be tough if you're a new driver. To get your best cars and truck insurance coverage rate, compare a number of quotes from various providers.

These can help balance out new motorist premium expenses. This short article will cover: How much does vehicle insurance coverage expense for brand-new motorists?

Your actual expense for brand-new motorist car insurance coverage depends in part on the insurance company you choose and the state you live in, to name a few factors. The table listed below shows the average annual rates from different nationwide service providers for full-coverage vehicle insurance coverage for new chauffeurs. How to get inexpensive car insurance as a new driver Policy alternatives, discount rates and car insurance company programs are available to assist you get your best and least expensive vehicle insurance coverage rates as a new chauffeur.

The Only Guide to Cheap Car Insurance For Young Drivers - Uswitch.com

Teenagers are thought about the greatest risk group of chauffeurs in the eyes of automobile insurance coverage business. It will still raise their general yearly premium, but no place near the total expense if you had your own car insurance coverage policy. To offer you a sense of the expense difference, the chart listed below shows the typical expense of full-coverage car insurance coverage for a brand-new chauffeur with their own vehicle insurance coverage versus the typical rate on a parent's policy.

Everything about How To Choose Your Car Insurance Wisely

https://www.youtube.com/embed/e28Oyj7sJ6gGetting on another's vehicle insurance plan can conserve over 50%. People who have actually never ever driven before are thought about high risk due to their strangeness with driving. This will pass in time, and while these motorists are nowhere near as high a risk as teenager chauffeurs, they still present one. New adult chauffeurs see higher rates than skilled drivers of the very same age.

AboutCar Insurance Coverage - Amica - The Facts

If you use appraisal, you and the insurance business each employ an appraiser. Your appraiser and the company's appraiser each quote the amount of your loss.

The umpire's decision is binding on both you and the insurance provider. You pay for your appraiser and half of the umpire's expenditures. You can utilize appraisal only for disputes with your insurance coverage company. You can't utilize it to resolve conflicts with another individual's insurance business. Your complaint must be in writing.

We can't decide who was at fault in a mishap or identify damage quantities. If your claim is for less than $10,000, you can use Justice Court.

If you win, you can get that refund. To learn more, call your county justice of the peace workplace. Learn more: What if my insurance coverage isn't paying enough?.

The 5-Minute Rule for Car Insurance Coverages - Alfainsurance.com

full coverage. You already know that full coverage is more costly. There is more to the decision-making procedure when going shopping for car insurance than rate. Liability protectionLiability car insurance coverage is the minimum amount of protection almost all states will require you to have. If you are at fault in a mishap, liability insurance coverage will pay for damages to third parties.

The cash it will cost to replace or repair your front end will have to come out of your pocket. Complete coverageFull coverage cars and truck insurance coverage includes the vital liability insurance coverage you are required to have, plus adds protection that pays for damages and losses to your automobile. As mentioned, if you rear-end someone, liability insurance coverage does not assist your scenario.

A few of the most typical are: PIP spends for medical bills on your own and any guests, no matter who caused the accident. It is likewise known as no-fault insurance. If the party responsible for the mishap does not have sufficient (or any) cars and truck insurance, your insurance company will pay for your damages.

You will likely owe more than it deserves at first. Gap insurance coverage will pay the distinction in between what your insurer will pay you for the vehicle and what you owe in payments. The optional coverage will spend for a rental vehicle while your automobile is not available due to the fact that it is in the shop due to the fact that of a covered automobile insurance coverage claim.

The smart Trick of What Is Comprehensive Car Insurance? - Business Insider That Nobody is Talking About

Liability insurance coverage is cheaper than complete coverage. But there are other elements that impact car insurance rates. Expense by genderLadies usually pay less for automobile insurance coverage, despite just how much protection they purchase. Refer to Bankrate's findings on the typical cost of car insurance for liability insurance coverage vs. complete protection, based on gender.

Even if you pay cash for your car, you might desire to buy more than the state's minimum liability insurance requirement. Say you live in California and have minimum coverage. The state requires all chauffeurs to have at least $15,000 per person and $30,000 per mishap in bodily injury liability, as well as $5,000 or more in property damage protection.

Based upon that scenario, it might be wise to buy as much vehicle insurance coverage as you can pay for. Many automobile insurance specialists suggest liability protection of 100/300/100 if you have possessions such as a house or business that somebody might pursue if you cause a costly mishap and do not have the coverage to back it up.

Frequently asked concerns, What does complete cars and truck insurance coverage include? Full vehicle insurance consists of liability insurance coverage to pay for others' damages and injuries, as well as comprehensive and accident insurance coverage to pay for damages to your vehicle.

The 45-Second Trick For Does Full Coverage Insurance Cover Someone Else Driving My ...

These are sample rates and need to just be utilized for comparative functions.

How do you know what types you require? Is it required by your state? Exist ways to conserve cash and still have the correct amount of protection? Listed below we information 5 kinds of coverages and supply a few situations where you would benefit from having a non-required protection contributed to your policy together with some tips to save some cash depending on your lorry and budget plan.

Liability insurance will cover the cost of repairing any residential or commercial property damaged by a mishap along with the medical expenses from resulting injuries. Many states have a minimum requirement for the quantity of liability insurance protection that motorists need to have. If you can afford it, nevertheless, it is usually a good idea to have liability insurance that is above your state's minimum liability protection requirement, as it will provide extra defense in the event you are discovered at fault for a mishap, as you are accountable for any claims that exceed your coverage's ceiling.

If there is a covered mishap, collision protection will pay for the repair work to your vehicle. If your cars and truck is totaled (where the expense to fix it surpasses the value of the vehicle) in an accident, accident coverage will pay the worth of your cars and truck. If your cars and truck is older, it might not deserve bring crash coverage on it, depending upon the value.

The Only Guide for Is This Covered By My Auto Insurance?

Keep in mind: If you have a lienholder, this protection is needed. What if something occurs to your cars and truck that is unassociated to a covered accident - weather condition damage, you hit a deer, your automobile is taken - will your insurance company cover the loss? Liability insurance and crash protection cover accidents, but not these situations.

https://www.youtube.com/embed/ZKqmN-K2HBI

Comprehensive protection is one of those things that is terrific to have if it fits in your spending plan. Anti-theft and tracking devices on automobiles can make this coverage somewhat more economical, but bring this kind of insurance coverage can be costly, and might not be required, specifically if your cars and truck is quickly replaceable.

AboutNot known Details About Teen Driver Car Accident Statistics & Facts - Edgar Snyder ...

You might be wondering; For how long can a kid remain on their moms and dads' car insurance? The reality is, parents can keep children on the family automobile insurance plan for as long as they desire, however it may not always make financial sense. In this regard, there are necessary aspects to think about.

Young boys may not have standard adult rates until they reach age 25 if they have a tidy driving record. Regardless of gender, teaching your teenagers safe driving is of the utmost significance, both for insurance rates and their safety.

"My son moved to Texas after college, where cars and truck insurance is a lot less expensive than it remains in New York," says Hartwig. "He worked and could afford his own insurance now." Reevaluate your automobile insurance coverage after graduation Numerous moms and dads normally decide to maintain teens on the family's automobile insurance plan up until they graduate from college, assuming they find employment and live far from house.

What Does How To Get Cheap Insurance For Teenagers - Realcartips.com Mean?

But if the kid can manage spending for his or her own auto insurance coverage, this is the time for the family to sit down and speak about it. Ask an insurance coverage representative Hartwig further recommends consisting of an insurance coverage representative in the discussion. "An agent has the risk and insurance expertise to help with a talk on the various kinds of insurance coverages that exist in the market and the importance in searching for insurance, comparing and contrasting the terms, conditions and costs of different policies," he says.

According to the Insurance Coverage Details Institute, adding a teenage chauffeur to your automobile insurance coverage can - which's if they have a pristine driving record. Teenage motorists have a much higher rate of mishaps due to their lack of experience and higher-risk habits. Some insurance business even decline to guarantee them.

The initial step, similar to anything to do with insurance, is to look around and compare rates. Various insurance coverage business treat teenagers differently and some will charge insane rates while others are more reasonable and offer discounts for young chauffeurs. It's important that you compare rates every year from the time your teen sarts driving till they turn 21.

Adding A Teen Driver To Your Insurance Policy? Can Be Fun For Anyone

If you have actually been with the same insurance business for a number of years,. This is due to the fact that insurance companies are most likely to offer you a break if your teen has a mishap or gets a ticket if you've been with them for a very long time. Here are some techniques to you should follow to cut your teenager's rates to the bone.

You wish to get them into a safe mid-sized automobile that isn't more than 6 to 10 years old (implying it has a few of the latest security innovation). In addition to saving you cash on cars and truck insurance coverage, this will offer you with peace of mind. It's best to include your teenager to your present automobile policy as a periodic motorist of the best car you own.

You ought to raise your deductible to at least $1,000 and even consider not having accident or thorough protection if the vehicle is just worth a few thousand dollars. This can conserve you over $500 each year. Many insurance provider use excellent trainee discount rates to teenagers who maintain a B average or better in school.

Fascination About Buying Your Teen's First Car? Here's How One Money Savvy ...

Some also use discounts if your teenager takes a driver's education course or completes special programs, such as those used by State Farm for motorists under 25. If your teenager goes off to college more than 100 miles away and doesn't take their vehicle, they will get a big discount rate and still be covered when they come house to go to.

If you think the premiums are high now, wait until you see what they'll end up being if your teenager gets a speeding ticket or gets into an accident.

You wish to keep your kid safe no matter what, but then they begin asking you for a vehicle. And the idea of them hitting the road solo makes you wish to employ a bodyguard and never let them leave your sight. For lots of kids, it's typical and even prepared for that their moms and dads will be buying them a car for their high school graduation.

Examine This Report on Teen Driving - Nhtsa

1. Safety Prior to you consider anything else, security is the number one thing to think of. As a parent, this is likely your main issue for your teenager's first automobile. You wish to ensure that they are pleased, however also feel comfy understanding they will be safe behind the wheel.

Prior to you think of models or various features, know what automobile is going to be the best for your kid. Any car you look at should satisfy minimum requirements of safety, such as functioning airbags, size and weight of the automobile, and power locks. 2. Price Variety Probably the 2nd crucial aspect to think about is your spending plan.

Presence This is key when it comes to how well your teenager will be able to drive the vehicle. Be sure and test drive the cars and truck with your teen before you buy.

All about Teen Drivers In New Mexico Are Deadly Road Hazards

If they can't see in one direction or their vision is obstructed for some reason, it's not the finest cars and truck for them. 4. Size Larger, sport energy vehicles are picking up. But that does not always mean you need to purchase the most significant cars and truck on the marketplace for your teenager.

Bigger cars and trucks can provide more protection in the case of a mishap compared to compact cars and trucks. Consider the way of life of your teen when believing about selecting the ideal size. They may be included in some activities or sports that need them to transport around additional equipment or need more storage.

Interruptions Try to chose an automobile that has very little diversions. Selecting an automobile that has Bluetooth capabilities and hands-free functions is an excellent idea.

8 Simple Techniques For 5 Important Credit Card Lessons For Teens And Young Adults

https://www.youtube.com/embed/uBBJ3TzNRH8For example, for sells cars and trucks that allows you to program secrets so that the stereo never discusses a specific level while they are driving. It likewise restricts the optimal speed they can reach. These features may be great alternatives. 6. Cost Effectiveness When picking good very first vehicles for teenagers, it's a great concept to consider the number of miles to the gallon a cars and truck will get.

AboutThe Best Strategy To Use For What Is Gap Insurance?

If your car is amounted to or taken before the loan on it is paid off, space insurance coverage will cover any difference in between your car insurance payout and the amount you owe on the vehicle. If you're funding a vehicle purchase, your lender might require you to have gap insurance for certain kinds of vehicles, trucks or SUVs.

Suggestion Some dealers provide gap insurance coverage at the time you purchase or rent a vehicle though it is essential to compare the cost to what traditional insurers might charge. How Space Insurance Functions It's fairly easy for a chauffeur to owe the lending institution or leasing business more than the vehicle is worth in its early years.

In terms of filing claims and automobile valuations, equity must equal the current value of the cars and truck. That value, not the cost you paid, is what your routine insurance will pay if the vehicle is damaged. The issue is that automobiles diminish quickly throughout their very first number of years on the roadway.

How What Does Gap Insurance Cover? - Cornerstone Ford can Save You Time, Stress, and Money.

One year later on, the vehicle is damaged and the insurance coverage business writes it off as a total loss. According to your auto insurance policy, you are owed the full present worth of that car.

Your collision protection will repay you enough to cover the impressive balance on your auto loan and leave you $2,240 to put down on a replacement vehicle. What if your automobile was one of the designs that do not hold their value? For instance, say it's diminished by 30% because you bought it.

This isn't as alarming as it sounds. If you put only a little money down on a purchase and pay the rest in little regular monthly installments spread out over 5 years or more, you don't instantly own much of that house or cars and truck complimentary and clear. As you pay down the principal, your ownership share expands and your financial obligation shrinks.

The smart Trick of What Is Gap Insurance? - Allstate Insurance - Youtube That Nobody is Talking About

You 'd be playing with fire without it, and, in any case, you're probably needed to have collision protection by the terms of your loan or lease agreement.

The average brand-new vehicle loan is in excess of $32,000. The typical loan term is now 69 months. You would not dream of avoiding crash insurance on that vehicle, even if your loan provider allowed you to do it. However you might think about space insurance to supplement your accident insurance for the duration of time that you owe more for that car than its real cash value.

This is most typically the case in the first few years of ownership if you put down less than 20% on the car and extended the loan repayment term to 5 years or more. A glance at a Kelley Directory will inform you whether you require space insurance coverage.

Some Known Questions About Frb: Vehicle Leasing: Leasing Vs. Buying: Gap Coverage.

How Much Does Space Insurance Cost? You can add gap insurance coverage to your regular extensive automobile insurance policy for as little as $20 a year, according to the Insurance coverage Industry Institute.

Dealers normally charge substantially more than the major insurance business. On average, a dealership will charge you a flat rate of $500 to $700 for a gap policy.

Space Insurance FAQs Here are some short answers to the most commonly-asked concerns about gap insurance. If there is any time during which you owe more on your cars and truck than it is currently worth, gap insurance can certainly be worth the money.

What Is Gap Coverage? - Bill Luke Santan Fundamentals Explained

By then, you ought to owe less on the car than it is worth. If the automobile is damaged, you will not have to pay out-of-pocket to make up the shortage in between the insured value of the automobile and the amount you owe a lender. Space insurance is particularly worth it if you make the most of a dealer's routine car-buying incentive.

Do You Requirement Car Space Insurance Coverage If You Have Full Protection? It consists of crash insurance coverage however also covers every unanticipated catastrophe that can destroy a vehicle, from vandalism to a flood.

So, you need gap insurance coverage if there is indeed a gap between what you owe and what the vehicle is worth on a used vehicle lot. That is probably to take place in the very first couple of years of ownership, while your brand-new cars and truck is diminishing faster than your loan balance is shrinking.

What Is Gap Insurance? - Bettenhausen Chrysler Dodge Jeep ... - The Facts

What Does Gap Insurance coverage Do? If your cars and truck is wrecked, and your comprehensive automobile insurance coverage policy pays less than you owe the lending institution, the space policy will make up the difference.

Your best option is to call your vehicle insurer and ask whether you can include it to your existing policy. Your insurance provider ought to have the ability to inform you what your choices are and how much including space protection might cost. Make certain to compare the finest automobile insurance rates to discover the right option.

Specifically, car gap insurance coverage is practical for those with considerable unfavorable equity in an automobile., not paying for space insurance coverage as soon as you do not Find more info truly need it is one way to conserve some money.

Getting The What Is Gap Insurance? - Insurance Options - Garavel Cjdr To Work

https://www.youtube.com/embed/dMtH7FvMRKIKey takeaways: Space insurance coverage pays when the amount left on your auto loan or lease is greater than the worth of your vehicle at the time it's declared an overall loss. Gap protection deserves it just as long as you are leasing an automobile or if you owe more on a loan than your automobile deserves.

AboutThe Greatest Guide To Frequently Asked Questions About Auto Insurance Claims

00 per day), the insurance provider needs to inform you where you can lease an automobile for that quantity. An insurance provider is only obliged to repay you for a rental car, or other replacement transport, for the period of time till the harmed lorry is fixed or, in case of a total loss, until the claim is settled.

How Cars And Truck Insurance Functions "How does vehicle insurance work?" We understand this concern is asked regularly. Understanding how cars and truck insurance works is necessary to make sure you're safeguarded every time you lag the wheel. To make sure you have the ideal insurance coverage coverages for your car, start by discovering an insurance business that you can trust.

Did you have any gaps in automobile insurance protection? What Is Vehicle Insurance? Car insurance coverage can assist pay for: Repair works Medical expenditures Rental charges Your state likely has cars and truck insurance coverage requirements for particular coverages that you'll need to follow.

!? Without it, you 'd have to pay for pricey claims out of pocket. This could put your individual assets at financial threat., start by investigating as lots of as you can.

When To Cancel Car Insurance After Selling A Car - J.d. Power Fundamentals Explained

We offer additional advantages that motorists can take pleasure in with their automobile insurance policy, such as assisting discover a repair work store or getting a rental cars and truck. How Does a Cars And Truck Insurance Deductible Work? When you get a vehicle insurance coverage, you'll pick your protection limitations and deductible. If you enter into an automobile accident and sue, you'll have to pay a deductible before you get protection from your policy.

Every vehicle insurance policy is unique to the chauffeur.

Within a couple of minutes, you can get an automobile insurance policy: Typical Questions About How Vehicle Insurance Functions How Does Automobile Insurance Work for Leasings?, you may not require extra insurance coverage that the rental company provides.

If you get a driving offense like a DUI or driving without insurance coverage, your state may need you to get an SR-22 to reveal you fulfill minimum automobile insurance requirements. You don't have time to wait aroundyou requirement to get where you're going. We can help by providing your SR-22 right away and letting the state understand you're coveredwith no filing fee.

The Basic Principles Of Acceptable Proof Of Insurance - Georgia Department Of Revenue

Get in touch with your insurance coverage company to discover out your state's existing requirements and make sure you have adequate protection. The majority of states require drivers to have an SR-22to prove they have insurancefor about three years.

Noted below are other things you can do to decrease your insurance coverage expenses. 1. Look around Prices differ from company to company, so it pays to shop around. Get at least three estimate. You can call business directly or access details on the Internet. Your state insurance coverage department might also offer contrasts of costs charged by major insurance companies.

It is necessary to pick a business that is solvent. Inspect the financial health of insurer with score companies such as AM Best () and Requirement & Poor's (www. standardandpoors.com/ratings) and speak with consumer magazines. Get quotes from different kinds of insurer. Some sell through their own agents. These firms have the same name as the insurance coverage company.

Ask pals and loved ones for their recommendations. Contact your state insurance department to find out whether they provide details on consumer grievances by business. Choose a representative or business representative that takes the time to answer your questions.

The Definitive Guide for Car Insurance Discount - New York Defensive Driving

2. Prior to you purchase a vehicle, compare insurance costs Before you buy a brand-new or secondhand vehicle, look into insurance expenses. Vehicle insurance premiums are based in part on the car's cost, the expense to fix it, its total security record and the likelihood of theft. Numerous insurers offer discount rates for functions that minimize the risk of injuries or theft.

Evaluation your coverage at renewal time to make sure your insurance coverage needs have not changed. Purchase your property owners and vehicle coverage from the very same insurer Lots of insurance providers will give you a break if you buy 2 or more types of insurance.

Inquire about group insurance Some companies provide decreases to drivers who get insurance through a group plan from their employers, through expert, business and alumni groups or from other associations. Ask your employer and inquire with groups or clubs you belong to to see if this is possible.

Seek out other discount rates Companies use discounts to insurance policy holders who have not had any mishaps or moving violations for a variety of years. You might likewise get a discount rate if you take a defensive driving course. If there is a young motorist on the policy who is an excellent student, has actually taken a motorists education course or is away at college without a car, you may likewise receive a lower rate.

The 9-Second Trick For How Long Before Insurance Premiums To Go Down After A Dui?

https://www.youtube.com/embed/aFLb6WaIbNQThe key to cost savings is not the discount rates, however the last cost. A company that uses couple of discount rates might still have a lower total cost. Federal Person Information Center National Consumers League Cooperative State Research, Education, and Extension Service, USDA.

AboutDoes A No Fault Accident Go On Your Record? [2021] - Honest ... Can Be Fun For Everyone

Your driving record is taken into account when you get your auto policythe more driving danger you have actually shown in the past, the more you may have to spend for your car insurance coverage premiums. It makes sense that your insurance company might re-evaluate your rates after claims or other driving events (such as moving violations) that are primarily your fault.

If your history gets markedly worse with severe traffic infractions or you have several accidents, your insurer may choose not to renew your policy. Some kinds of mishaps are worse than othersfor example, a driving under the influence incident is likely to trigger a nonrenewal from virtually every insurance coverage business. It's always best to report a mishap If you're unwilling to file an auto insurance claim since you fear that your premium will increase or your policy will be canceled, comprehend that you will be taking a danger by not reporting an event, even if the damage appears small.

Being associated with a cars and truck mishap can be both an extremely scary experience, in addition to a very expensive and bothersome one. Even if you aren't seriously hurt, you will have to file an authorities report, should be checked out by a physician, and then will have to deal with various insurance declares over the next weeks or months.

If you're in a vehicle mishap, you will get points based on the irresponsible action that caused the crash (i. e. speeding or careless driving). The Illinois Department of Motor Cars maintains driving records that show activity and points examined for minor offenses for four to five years, depending upon the offense.

Getting My After An Accident: Understanding The Claims Process To Work

Your insurer might utilize this as a reason to raise your rates and make you pay a greater premium. While your insurance company might be within its rights to raise your rights if your irresponsible behavior causes an automobile accident, it ought to not punish you for being the victim of a crash that was caused by the fault of another.

If you read this post, you might have entered a cars and truck mishap recentlyor you know somebody who did. Initially, we hope nobody was seriously harmed. Secondand we dislike to offer you more bad newsthere's an opportunity that even if you weren't hurt at the scene, you may feel some pain in your pocket the next time your cars and truck insurance is up for renewal.

Again, there's a chance your premium will stay exactly the exact same., a non-profit dedicated to helping the public comprehend how insurance coverage works.

Exactly just how much more you'll need to pay varies from business to company and depends on the intensity of the accident. If you are at fault and somebody is hurt, you will more than likely lose your excellent driver discount and might see a 20 to 25% premium boost, These boosts generally remain on your premium for three years.

8 Simple Techniques For Dui-related Accidents And Car Insurance - Nolo

Here's some suggestions on how you can put the brakes on any premium increases after you've been associated with a car accident. Repair expenses and medical expenses aren't the only financial blows that can come after you are associated with a mishap. You may find that your cars and truck insurance coverage rates increase as well, as much as 32%, even if you weren't found at fault.

Because private automobile insurance coverage rates differ, based on aspects like driving history and age, it is hard to say exactly just how much more you can expect to pay. If you have actually been associated with other mishaps, you can almost bet that your insurance coverage will go up more than somebody who has never had a mishap before.

This gets rid of the stress of getting a suddenly high expense in the mail and offers you, and your budget plan, time to adjust. 1. Inform your insurance provider about the mishap, no matter how small it was If you caused a small mishap in which nobody was injured, or you weren't at fault, you may be lured to simply not tell your insurance coverage business about it.

Since some insurers have actually accepted that accidents are merely a part of life, they want to disregard your very first incident and not raise your premium. "The details vary by business," states Worters. "Some may give you mishap forgiveness immediately, while others will only do so after you have actually been an accident-free policyholder for as lots of as three to five years.

Not known Factual Statements About How Far Back Do Auto Insurance Companies Look?

"But otherwise, it might assist reduce rates. Don't await your insurer to ask you to do this. Do it on your own and inform them about it." You can discover a driver's ed refresher course in your state here. Premiums differ substantially from company to business. If you have home insurance coverage through another supplier, include it on your list of prospective automobile insurance companies.

Potential insurance companies will ask you to report any mishaps and moving violations you have actually received over the last couple of years. Do not lie. They'll discover all reported accidents or tickets in their databases. Cash shouldn't be the only element when making your last decision. Select an insurance provider that has a reputation for great client service and is economically steady Inspect customer publications and your state insurance coverage department for consumer complete satisfaction studies and find out if they are solvent through ranking business such as A.M.

Posted on Nov 10, 2015 If you have actually just been in a car mishap or ticketed for a traffic infraction, you might have heard contrasting details relating to how long the accident or ticket will remain on your record and how it will affect your insurance coverage premium. The short answer is that the, but the precise penalties you receive for your traffic offense depend on several aspects, including: Your insurer, How long you have actually been with your supplier, Where you live, How old you are, The severity of the accident or violation, The expense of the damages Let's break down what kinds of accidents and traffic infractions do and do not impact your insurance coverage premiums and for how long.

The Basic Principles Of How Much Does Insurance Go Up After An Accident?

It's when you get into a second or 3rd at-fault mishap within that timeframe that you could experience a substantial rise in your insurance premium. If you drive your automobile into a tree and claim crash protection, the event goes on your record as an at-fault accident, even though no one else was included.

https://www.youtube.com/embed/9HLZZcmWyq0

Your rate could depending on factors such as fault, severity and expense of the damages. You'll likewise lose any safe-driving discount rate you qualified for prior to the mishap, which further increases your premium. When it comes to the length of time your policy rate remains increased, that depends on the state, insurance coverage company and whether you get into another accident.

AboutSome Known Details About When You Don't Need Vehicle Insurance - Citizens Advice

It's typically submitted with your state for three years and shows that you're bring the minimum necessary insurance.

What Happens if Car Insurance Lapses? Letting your car insurance coverage lapse isn't unusual, however it can be costly.

It's essential to keep constant automobile insurance protection, even if it's the minimum quantity your state needs. A car insurance coverage lapse is a period of time when you own a vehicle however you do not have automobile insurance protection.

Getting My Official Ncdmv: Vehicle Insurance Requirements - Ncdot To Work

If you're in an accident and you don't have protection, you might be responsible for damage or injuries. Vehicle Insurance Coverage Lapse Grace Duration You may have a lapse in protection due to the fact that you missed the due date on your regular monthly vehicle insurance payment. If it's just been a brief amount of time, your insurance business may permit you a grace duration.

If it hasn't been too long, they can likely renew your policy so you have continuous protection.

To be sure you're safeguarded, get a vehicle insurance coverage quote by calling us at 888-413-8970 or get a quote online. Exists a Penalty for Lapse in Car Insurance Coverage? Practically every state needs you to have automobile insurance coverage to legally drive your automobile. Even if you're driving a registered car, the charges you'll deal with if you're caught driving without insurance coverage may include: Fines of approximately $5,000 License suspension Impounding of your vehicle Prison time What Happens if Your Insurance Coverage Lapses and You Have a Mishap? If you're in a cars and truck mishap while driving without insurance, you might be held economically responsible.

The Single Strategy To Use For Auto Insurance Faqs

The best method to make sure you're secured is to keep constant coverage and prevent a car insurance lapse by: Paying your cars and truck insurance coverage premium on time Renewing your insurance policy Doing your finest to keep a clean driving record How Long Does an Insurance Lapse Stay on Your Record? If you've had a lapse in protection, you might have to file an SR-22 with your state for 3 years to prove you have bought a minimum of the minimum vehicle insurance required.

It can also potentially impact your future cars and truck insurance coverage premiums. It's finest to keep constant protection to get the best insurance coverage rate and make sure that you're protected in an automobile mishap.

You may, nevertheless, need to pay taxes on a few of the money value if the amount exceeds what you have actually paid in premiums. There might be a "reduced paid-up" option. This suggests that you can stop paying premiums completely in return for a minimized death advantage and no money conserving.

When To Cancel Car Insurance After Selling A Car - J.d. Power Fundamentals Explained

If this occurs, see if the policy can be restored. Some insurers might permit this if you do it within 5 years of lapsing. You will probably have to Home page pass a physical exam for the restored policy and pay back the premiums you would have paid plus interest. Yearly premiums for the renewed policy might be lower than those for a new, similar policy.

What Is a Totaled Vehicle? Many states set a limit for when an insurance company should amount to a cars and truck. State law may require an insurance company to total a car when the expense to repair it is more than 75% of the vehicle's ACV.

If the overall loss formula in your state is set at 75%, your insurance company will total your car due to the fact that it'll cost more than $7,500 to fix. But if a mechanic can repair your automobile for $5,000, your insurer will likely reimburse you for the cost to repair it. Get the fundamentals on vehicle insurance coverage and repair alternatives after a mishap.

Pay Insurance Fines Online - Georgia Department Of Revenue for Beginners

Automobiles depreciate (decline in time), so your insurance settlement may be thousands of dollars less than what you owe on your loan. Let's say you spin out and hit a stop sign. Your automobile is amounted to. The insurer says your automobile's ACV is $8,000, however you still owe $10,000 on your loan.

You still need to pay the remaining $2,000 on your loan, even though your car is wrecked. (See below to discover how space insurance coverage can safeguard you from this monetary danger). If your automobile's ACV is more than you owe on your loan, the insurance company will settle your loan first and you will get to keep the rest of the settlement check.

For pointers on what to do if you disagree with the insurance provider's appraisal of your automobile, take a look at The Insurance Provider Says My Car is a Total Loss-- What Now? If You Do Not Have Insurance coverage Driving without insurance or other proof of monetary capability is prohibited in many states.

See This Report about Car Insurance After Lapsed Coverage

https://www.youtube.com/embed/wW9uMLwlVEI, you will have to continue to make loan payments until your loan is paid off. If the accident involves another motorist or somebody else's home, you may get sued.

AboutWhat Does Average Car Insurance Rates By Age And State - Wallethub Mean?

Cars and truck insurance does decrease at 25. The typical price of vehicle insurance for a 25-year-old is $3,207 for a yearly policy. By contrast, drivers pay an average of $7,179 at 18 and $4,453 at 21 which shows that vehicle insurance does decrease as you age. Nevertheless, this milestone isn't as wonderful as you may think.

Check out on to discover more information about when vehicle insurance does go down. When does car insurance get less expensive for young motorists?

The Best Strategy To Use For Here's When Your Car Insurance Rates Start To Go Down

What age does automobile insurance decrease for male vs female chauffeurs? Your car insurance coverage does decrease after you turn 25, but not as much as it does on other birthdays. Unless you live in a state where insurers can't factor gender into insurance coverage rates, one considerable change take place at age 25: the difference between what male and female motorists pay for car insurance coverage.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

Does cars and truck insurance coverage from significant nationwide insurers decrease at 25? We evaluated quotes from 4 of the biggest automobile insurance coverage business Geico, State Farm, USAA and Progressive and discovered that while vehicle insurance coverage does decrease at 25 with each of them, the quantity it reduces by varies considerably.

More About How Is My Car Insurance Calculated? - Confused.com

Unless you reside in one of the few states that have made it illegal, a lower credit rating may increase your car insurance coverage premiums. If you transfer to a community with higher rates of theft and vandalism, then insurers will charge you greater premiums to account for the increased risk of damage or theft.

Every insurance business determines rates differently, and some insurance business will emphasize various aspects more greatly than others. We suggest reassessing your insurance provider every year to get the best rate. How to get cheaper automobile insurance coverage as a 25-year-old chauffeur If you're a young motorist in your 20s, you have actually likely wondered how to reduce your auto insurance expenses.

The 45-Second Trick For Does Car Insurance Go Down After Car Is Paid Off?